TRANSFORMING OUR SUPPLIER BASE

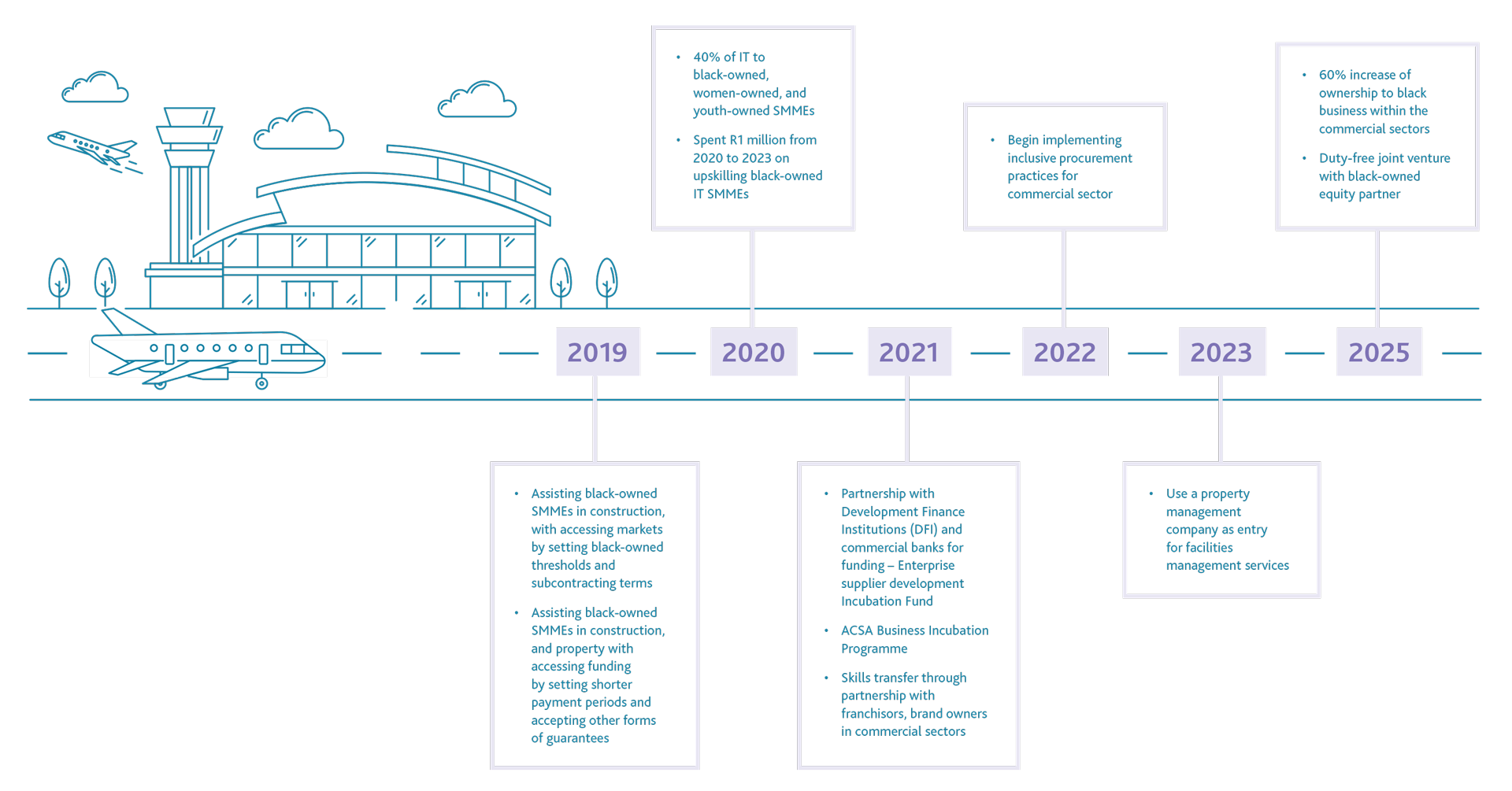

Our economic transformation strategy was developed and adopted in the 2020 financial year. This strategy highlights key initiatives in seven sectors, as detailed below.

SEVEN KEY SECTORS

Our strategies in the seven key sectors we have identified are focused on preferential procurement and enterprise development.

In the advertising, car rental and retail sectors, we engage in non-aeronautical revenue-generating commercial activities and contribute to the transformation of suppliers and service providers through various enterprise development initiatives.

In the ground handling sector, we do not engage in any commercial activities but contribute to transformation by setting specific transformation requirements in our ground-handling licence agreements and by providing access to enterprise development opportunities.

In the construction, ICT and property sectors, we support transformation in our supplier base through the preferential procurement of goods and services with set procurement performance targets which are monitored and reported using a transformation barometer dashboard.

PREFERENTIAL PROCUREMENT

During the course of the previous period, we identified our top 100 suppliers and actively engaged with them about the impact of Covid-19 on our business and theirs. We also conducted a B-BBEE analysis of our top 20 suppliers and identified that there was a risk that their B-BBEE ratings could be downgraded due to measures they had to take in response to the pandemic. As part of our ongoing supplier performance monitoring process, we therefore actively engaged with them to ensure that they could and would remain B-BBEE compliant.

This process continued throughout the reporting period and we continued to make use of the barometer dashboard that we put into place in 2020 to monitor actual procurement spend against targets. Our revised flagship projects in construction, IT and commercial remained a priority to ensure that we were able to meet our procurement targets in these sectors regardless of the implementation of our Capital and Operational Expenditure Reduction Programme.

In terms of this, capital expenditure for the year was cut back significantly, with expenditure being limited to airport maintenance and resilience instead of expansion and growth. Most uncontracted projects remained on hold and will only be resumed once funding is again available, which is expected to be during the current period.

CONSTRUCTION

Our overall performance in the construction sector exceeded the target (80%) with 86% of the controllable spend (R985.1 million) going to B-BBEE suppliers. Of this 86% (R838.4 million) of procurement spend going to 51% black-owned suppliers, against a target of 50%; and 67% (R655.7 million) of procurement spend going to 30% black women-owned suppliers, against a target of 15%. Furthermore, R96.3 million of the controllable spend supported EME suppliers, accounting for 9.79% of total spend against a target of 20%, R269.2 million supported QSE suppliers which is 27% against a target of 20%, R21.5 million supported Youth owned suppliers which is 2.19% against a target of 20% and R11 million supported People with Disabilities owned suppliers which is 1,17% against a target of 10%.

IT

Significant progress was made in IT with the current performance on contracted projects for FY 21/22 largely in line with the transformation plans inclusive of the approved IT transformation targets in all IT contracts. The opportunity to take advantage of the competitive innovation landscape through the digitalisation of the redundant processes is being implemented. Our strategic projects will deliver secure, innovative, disruptive and resilient digital platforms to meet customer expectations and deliver on our B-BBEE commitments.

The ICT sector performance shows that 67%% (R293 million) of the IT budget was spent with black-owned companies, of which 36%% were owned by black women and 1%% were owned by black youth or suppliers with disabilities.

PROPERTY

Despite budget constraints, we continue to contribute to broader socio-economic transformation through our key 10-year flagship development projects.

One of the most significant of these has been the construction of the new head office complex at O.R. Tambo International, which was completed during the previous period. The complex consists of three buildings, all of which comply with the highest standards set by the South African Green Building Council. The Council is part of a global network of building councils that is leading the transformation of the built environment in order to make it more sustainable and environment-friendly.

During the reporting period we also continued to engage with advocacy organisations such as the South African Property Owners Association, the South African Institute of Black Property Practitioners and the Women in Property Network. On an ongoing basis, we consult our industry partners to enhance their understanding of our transformation journey and of how this can contribute to the success and sustainability of both our business and their businesses.

COMMERCIAL

Our three flagship commercial sector projects, which were put on hold in 2020, were ultimately abandoned due to the prevailing trading and financial conditions as these are not conducive to large-scale transformation projects.

Revenue from black-owned business with a 51% or more black ownership accounted for 42% of all core commercial revenue from the retail, advertising and car rental businesses. This exceeded the FY2022 target of 40% by two percentage points.

ENTERPRISE AND SUPPLIER DEVELOPMENT

Our enterprise supplier development initiatives support not only large companies, but SMMEs as well. We include SMMEs in our supplier base and provide both financial and non-financial support in order to increase economic participation and stimulate job creation. This, in turn, supports the growth and sustainability of the aviation sector while also advancing our own transformation objectives.

With our support, SMMEs can grow into scalable businesses that have the potential to become part of our supplier development programme and, ultimately, to become preferred procurement partners.

During the course of the year, we undertook the following enterprise development initiatives:

The 2021 Entrepreneur Programme

Collaboration with the iLembe Chamber of Commerce, which supports enterprise development initiatives, continued during the reporting period. The Entrepreneur Programme is a business accelerator programme that aims to uncover the entrepreneurial potential in the iLembe District in KwaZulu-Natal, assist in the development of entrepreneurial enterprises and support them in the process of becoming fully sustainable.

A total of 50 entrepreneurs entered the 2021 competition, and 26 finalists were selected to participate in the 2021 programme. All of the finalists committed themselves to the rules of the programme by signing a participation agreement.

Of the initial 26 entrepreneurs selected, a total of 20 completed the programme. Each of these received a certificate of completion from the UKZN Graduate School for Business and Leadership, as well as an iLembe Chamber of Commerce membership certificate. The winners received business support funding to the value of R75 000, as well as media prizes to the value of R75 000.

Rental Reprieves for Concessionaires

An enterprise development opportunity presented itself when the business took the decision to give commercial concessionaires rental reprieves for a period of nine months to the value of RR591 million. ACSA would have generated additional revenue from the discounted rental amounts offered to the tenants as relieve from the effects of the pandemic.

Paul’s Ice Cream

Paul’s Ice Cream is a 100% BWO business operating at O.R. Tambo International and is one of the food and beverage spatial portfolio beneficiaries. An enterprise development agreement is in place to support this SMME with equipment and start-up stock as well as rental for the first 12 months of operation.