RUN AIRPORTS

OVERVIEW

Running airports is our core business and is essential to our value creation process. As we emerge from the pandemic, this remains our primary focus as we work to secure our sustainability and create a viable platform for future growth.

Over the past two years, we have reimagined the way in which we run our business and have reconfigured our operations to ensure that we are a more flexible, efficient and adaptable organisation. Our most immediate task, then, is to restore our operations to full functionality, to build passenger confidence, to diversify our revenue streams in response to the fundamental changes that have taken place in air transportation, and to begin laying the foundation for a new kind of airport network in a new kind of socio-economic environment.

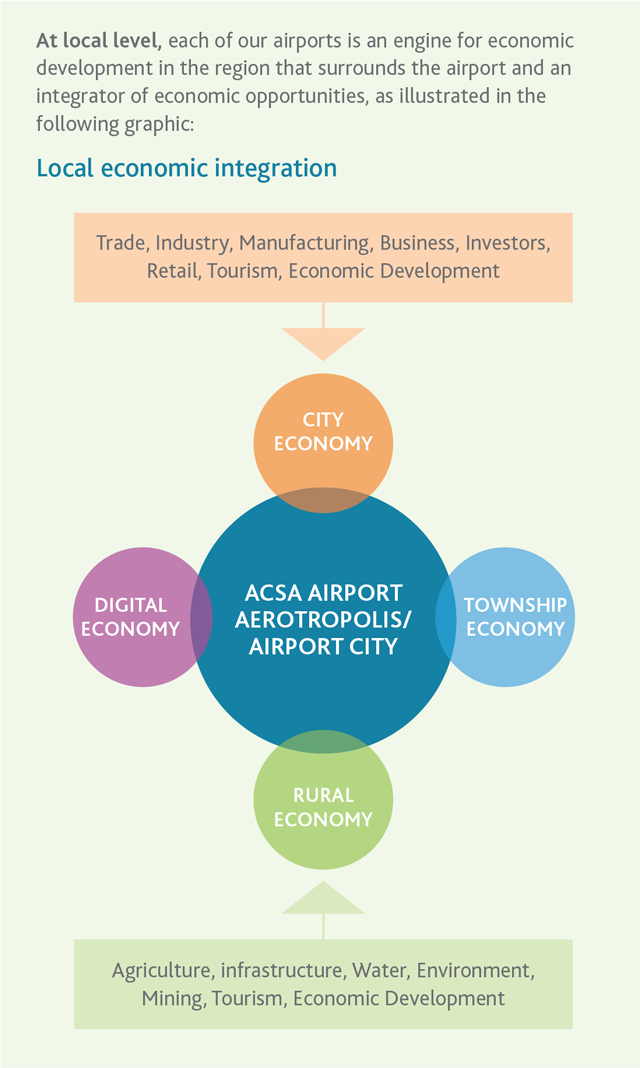

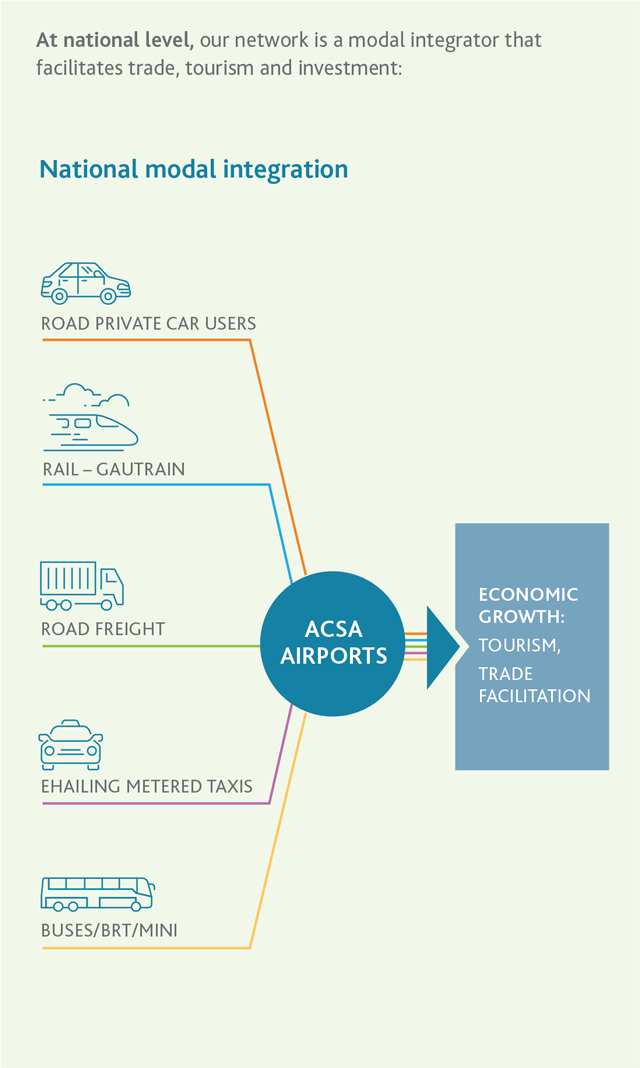

Airports are not only transportation nodes, but have a very important role to play in the country’s recovery from the pandemic. We see our network within this broader context and as a means to facilitate economic integration at both local and national level.

Our network therefore has an essential role to play in supporting the national efforts to reconnect, recover and rebuild economic activity. During the reporting period, we nevertheless faced the ongoing challenge of having to deal with the pandemic and its impact on both aeronautical and non-aeronautical revenue. In the previous period, there was a massive drop-off in passenger traffic but, as restrictions began to be eased at the start of the 2022 reporting period, signs of a recovery became evident. This was nevertheless intermittent as new variants of the virus led to further lockdowns during the course of the year. It was only when there was a significant easing of travel restrictions just prior to the December 2021 holidays that our recovery trajectory became more consistent.

This nevertheless has to be seen within the context of a changed operating environment, which is very different to what it was prior to the pandemic. There have, for instance, been significant structural changes to the air travel market. Both government and business cut back on air travel in compliance with the regulations introduced during the first ‘hard’ lockdowns of 2020 and, with remote and hybrid working solutions now entrenched, air travel within the MICE (meetings, incentives, conference and exhibitions) category is unlikely to recover to pre-COVID levels.

Recovery is, instead, being led by the leisure and VFR (visiting friends and relatives) segments, with growth in these segments most likely to come about as a result of the African free trade agreement currently under discussion rather than from more developed markets. This means we are seeing a decline in real earnings from air travel, which is likely to become a persistent feature of our aeronautical revenue stream.

PASSENGER TRAFFIC

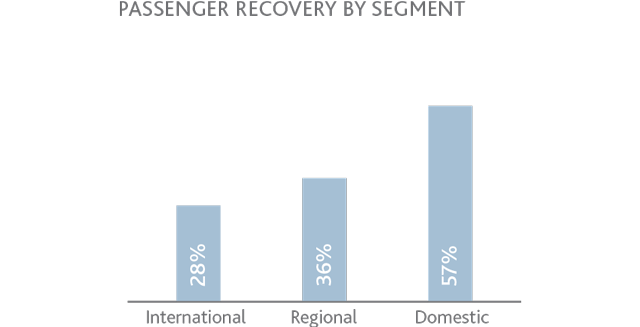

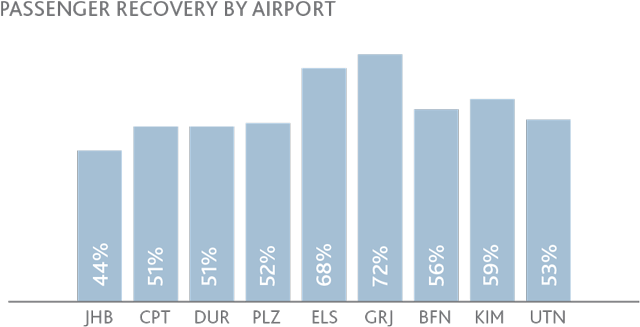

As expected, passenger travel, in particular, continued to be impacted by COVID-related travel restrictions throughout the reporting period, particularly during the second and third waves. On an annualised basis, though, total passenger numbers improved to 49% of pre-COVID levels, with a total of 21 million passengers passing through the network, including both arriving and departing passengers.

The business and MICE segments (meetings, incentives, conferences and exhibitions) were the most severely impacted due to reduced travel budgets and the rapid uptake of virtual meeting and conferencing platforms. These segments, which include government, nevertheless accounted for 50% of the passenger traffic through our three largest international airports. This was due to the fact that most of the international airlines operating flights into South Africa resumed service during the course of the year and many domestic carriers restored their pre-COVID networks, albeit at a reduced scale. New domestic carriers are now also providing added capacity, which is contributing to our recovery.

As we expected, the domestic segment improved to 57% of its pre-COVID throughput on an annualised basis, while regional and international segments lagged behind. The domestic segment accounted for 83% of total throughput during the year compared to 70% pre-COVID. While recovery at the large international airports was driven by the business and MICE segments, regional recovery was driven more by the leisure the VFR (visiting friends and relatives) segments.

The recovery of the international segment has been slower, largely due to the persistence of travel restrictions right through to the fourth quarter. After these began to be eased, international traffic began to improve and this had a knock-on effect on domestic travel with many international travellers taking connecting flights to domestic destinations. Passenger traffic trends analysis shows the international tourism segment continues to be dominated by the European market, which accounted for 39% of international tourist arrivals pre-COVID. We have therefore identified the African market as a focus for development and ultimately aims to connect South Africa with every major city in Africa. This will significantly diversify the international source portfolio and support Africa’s integration agenda, as expressed in the Abuja Treaty of 1991.

The impact of the continuing war in Ukraine, mainly through its impact on energy prices and consequently on inflation in large source markets like Europe and the USA, nevertheless has the potential to affect our recovery, although the extent to which this will happen is uncertain.

PASSENGER SATISFACTION AND AIRPORT HEALTH ACCREDITATION

Passenger satisfaction

For the past two periods, passenger throughput was insufficient to comply with the ACI World’s Airport Service Quality (ASQ) data collection survey. As a result, we were unable to measure passenger satisfaction at our airports through the ACI programme. We did, however, develop an internal survey to measure satisfaction levels among passengers. We will return to monitoring passenger satisfaction through the ACI programme in FY2024.

ACI Health Accreditation Programme

All of the airports in our network are registered on the ACI Airport Health Accreditation Programme. This provides for airports to be regularly assessed in order to ensure that their health measures are aligned with the ACI Airport Operations and COVID-19 Business Recovery Guidelines as well as with the ICAO Council Aviation Recovery Task Force (CART) recommendations and industry best practice.

Throughout the pandemic, our health management practiceswere also aligned with the ACI Aviation Business Restart and Recovery Guidelines and the ICAO Council Aviation Recovery Task Force recommendations. Our participation in the ACI programme demonstrates to passengers, staff, other airport users, regulators, governments and the public in general that we prioritise health management in a formal, established and measurable way.

SAFETY

Airports Company South Africa is obligated to comply with SACAA regulations concerning the management of communicable diseases posing a serious public health risk and has to ensure that appropriate precautionary measures are in place to reduce that risk.

Prior to the pandemic, we had exiting procedures in place to deal with public health emergencies, and these were upweighted in compliance with government-mandated measures to prevent the spread of COVID-19 and compliance was closely monitored. Before any of our airports could re-open after the initial “hard” lockdown, our state of readiness had to be approved by SACAA, which conducted thorough inspections to ensure that we were complying with regulatory requirements.

All of these regulatory requirements were lifted on 22 June 2022 post year-end, but we remain vigilant to any public health risks that may present themselves and committed to ensuring the safety of passengers and other airport users. As part of this commitment, we continue to develop our digital services in order to minimise the need for physical contact and to improve the overall user experience.

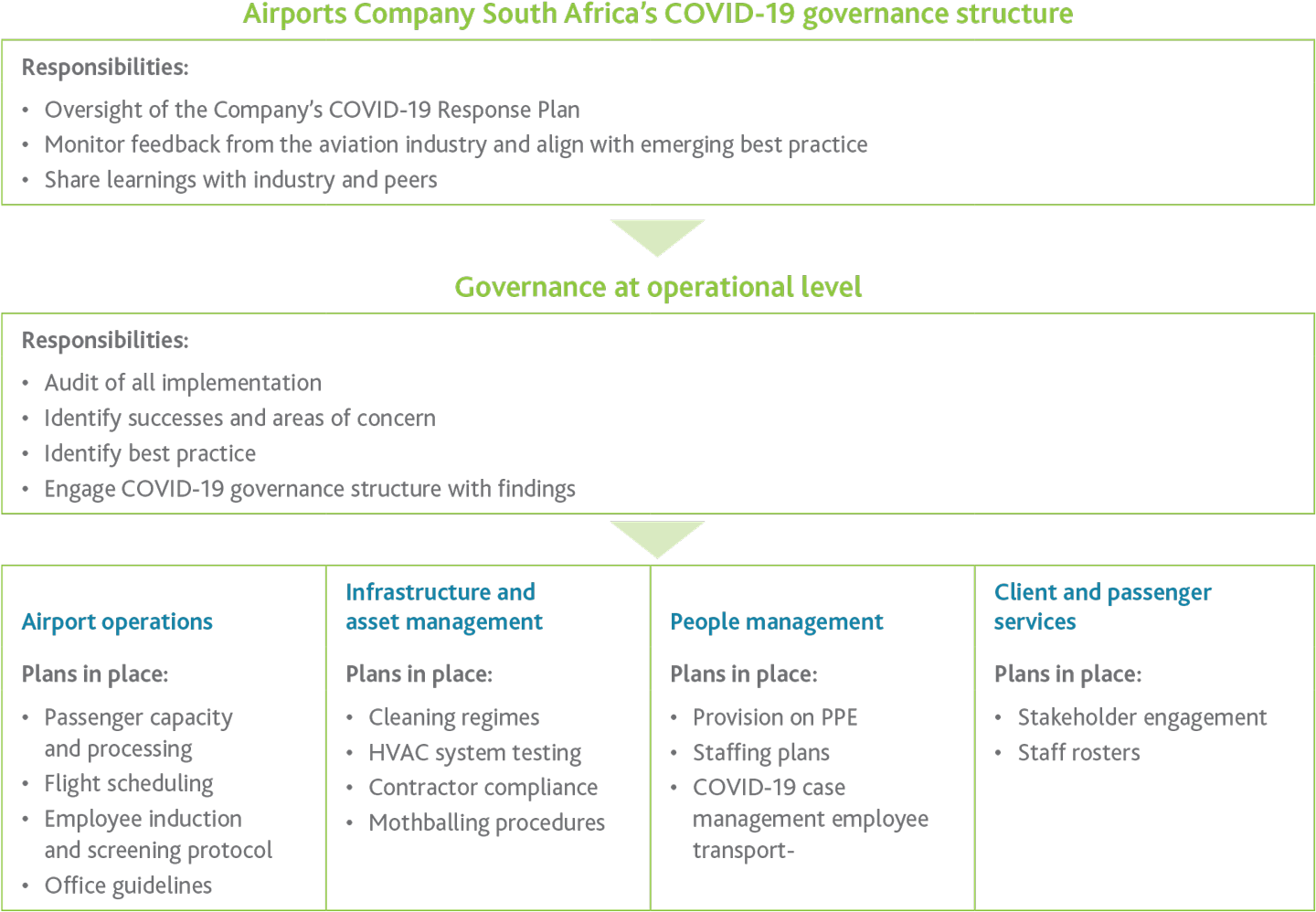

Our COVID-19 response programme, which was still in place throughout the reporting period, is illustrated in the following graphic:

Within this framework, a COVID-19 compliance dashboard was implemented to track stakeholder compliance to regulations. Reporting on compliance was conducted three times a week and information from all nine airports was accordingly updated on the reporting dashboard. From June 2020 to 31 March 2022, number compliance audits were conducted across our network.

In addition, we engaged ACI to develop new passenger facilitation protocols based on guidance by ICAO and the IATA. The measures implemented at our airports conformed to the standards set out by these organisations.

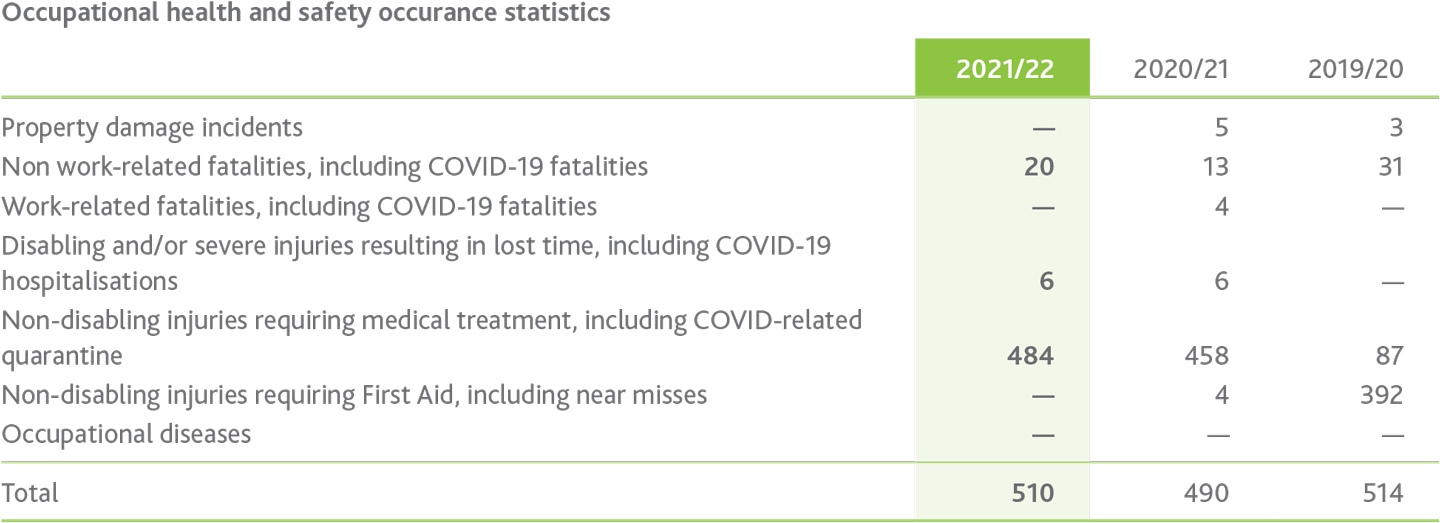

Occupational health and safety (OHS)

In the previous period, we developed and implemented a new safety management system based on the principles of ISO 45001. All historic data was collected and migrated to the new safety management standard, to which all its airports subscribe. As well as adhering to strict internal procedures, we manage a large number of infrastructure-related projects, which results in an influx of contractors and service providers. This elevates the risk of injuries within our facilities. We therefore have a stringent contractor management programme and all of our contractors are screened for compliance with Occupational Health and Safety requirements prior to commencing work at any of our airports.

As we also have a large number of stakeholders operating at our airports, it is critical that all of them comply with applicable Health and Safety requirements. We have carefully monitored the start-up of stakeholder operations post-lockdown to ensure that levels of compliance are maintained. A total of 113 inspections were conducted during the reporting period in order to maintain compliance at all airports.

We have on-site OHAS clinics at four of our airports: O.R. Tambo International in Johannesburg, Cape Town International, King Shaka International in Durban and Chief Dawid Stuurman International in Gqeberha (formerly Port Elizabeth). These fully equipped clinics had a very important role to play in our frontline response to the pandemic.

At our other airports, local occupational health service providers are contracted through a nationally appointed service provider to deliver consistent service to all staff and airport users.

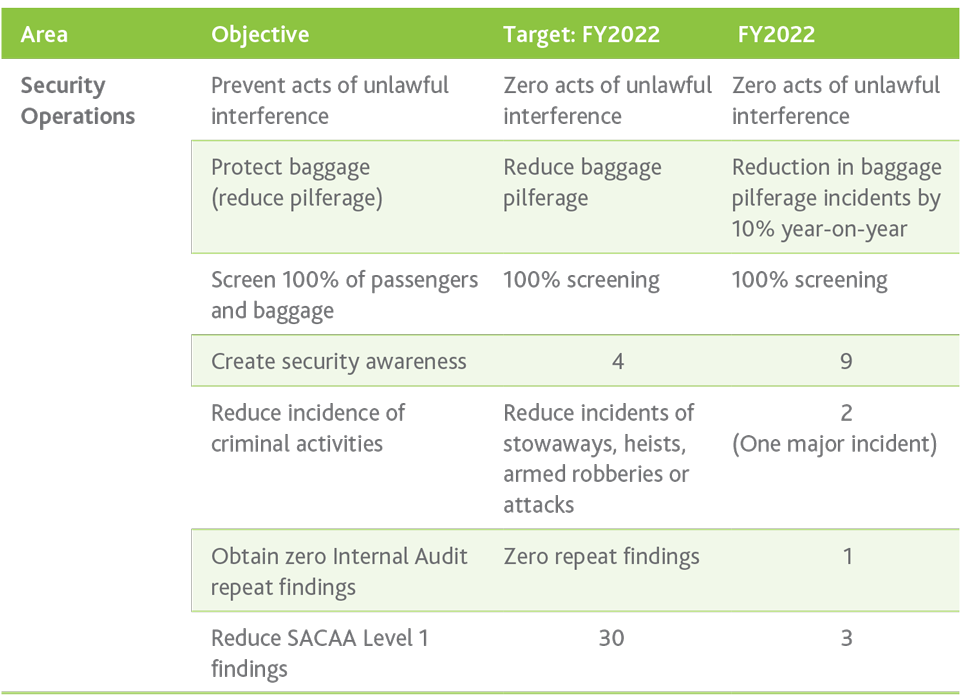

SECURITY

We have a risk-based, multi-agency approach to threats and emergencies relating to both airside and landside operations at all of our airports.

Throughout the pandemic, all of our airports had to align their security operations with the recommendations and guidelines of ICAO, SACAA, IATA and ACI in order to create a positive customer experience without compromising on hygiene and safety. A touchless security process for both passengers and baggage was seamlessly implemented as soon as our airports became operational again after the initial lockdown and were welcomed by the public. Especially from a customer experience point of view, it was notable that there were no bottlenecks due to social distancing in our queue management system.

Smart security technology was partly operationalised at O.R. Tambo during the previous period, but a further roll-out was delayed due to budget constraints once the new Financial Plan had been put into place. We also continued to optimise security deployments in all of our airports in order to minimise outsourced contract costs. This created efficiencies in operational costs, which have benefitted the organisation as a whole. Throughout the reporting periods, training was deferred in observance of the COVID-19 regulations, but we continue to collaborate with the various service providers we use in order to provide a seamlessly safe and secure service.

A key focus of enterprise security during the various levels of lockdown was the protection of our perimeters and access gates as well as the prevention of vandalism of infrastructure. We heightened security measures by increasing law enforcement visibility in and around our airports and reduced access to the airside and terminal buildings.

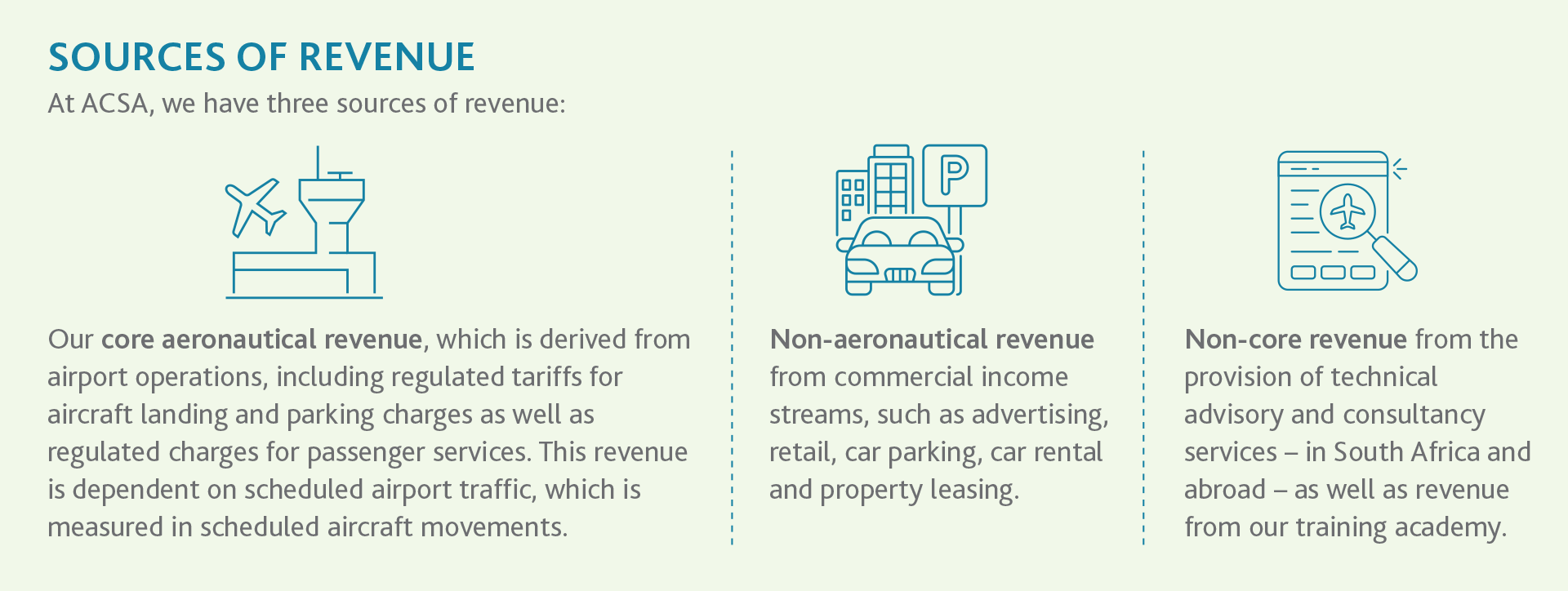

AERONAUTICAL REVENUE

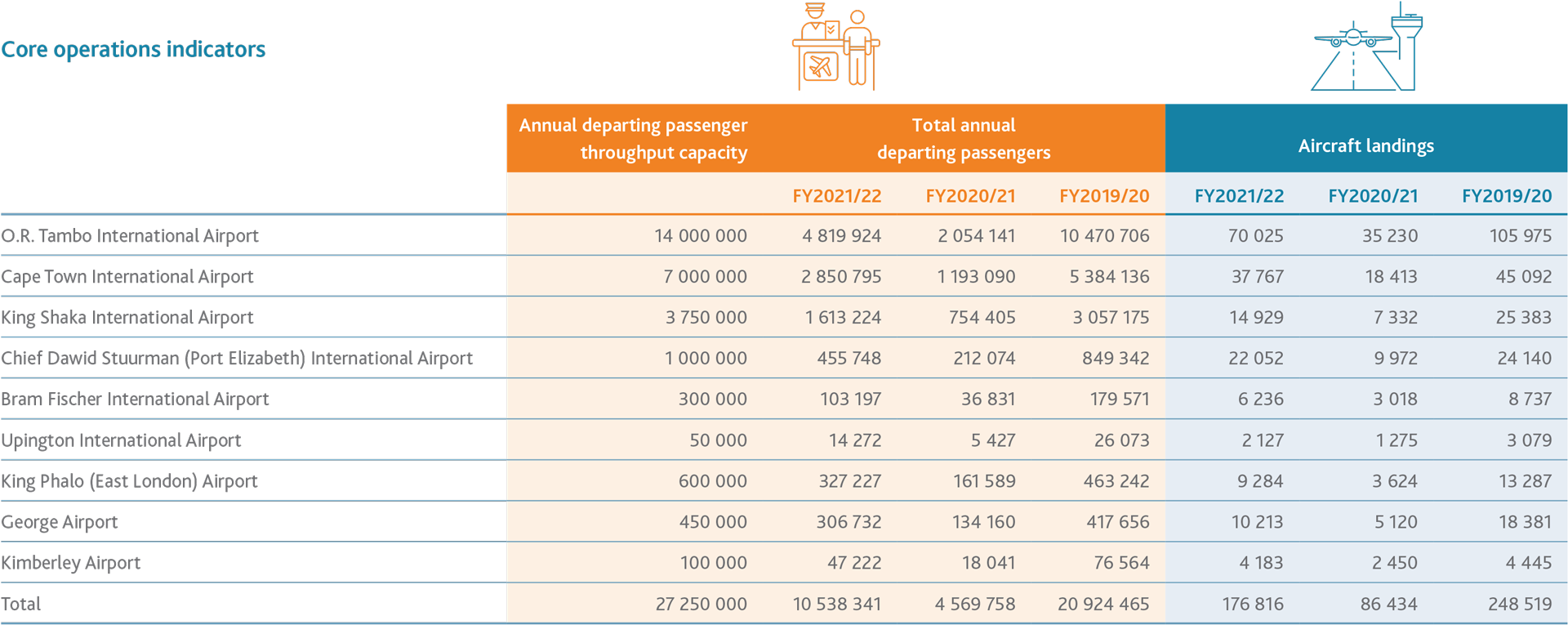

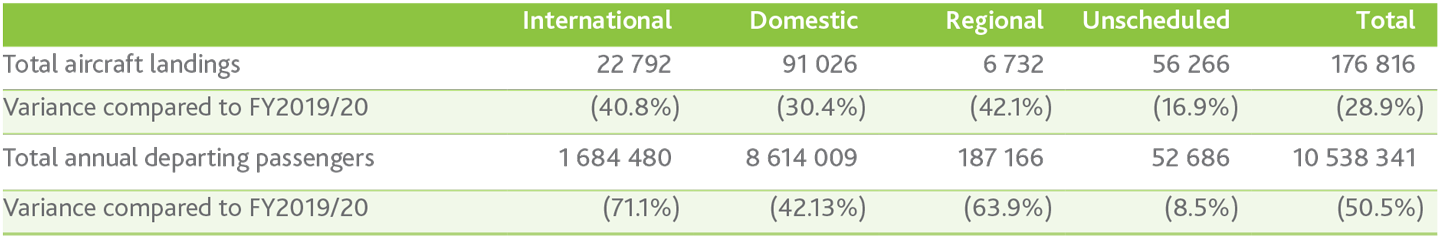

Aeronautical revenue, which is derived from regulated tariffs for aircraft movements and related services, improved by 122% to R1.8 billion during the reporting period (2021: R810 million). This was due to increases in the number of aircraft landings and departing passengers as well as the 3.3% tariff increase for the year. Aircraft landings improved by 105% to 176 816 (2021: 86 434) and departing passenger numbers improved by 131% to 10 538 341 (2021: 4 569 758).

NON-AERONAUTICAL REVENUE

Our non-aeronautical revenue is generated from two businesses: the core commercial portfolio and the non-core commercial portfolio. The core commercial portfolio includes six businesses: advertising, retail, car parking, car rental, property and ICT commercialisation. The non-core commercial portfolio includes training, consultancy and advisory services business. In addition to contributing to revenue, these businesses provide many opportunities to further our broader transformation agenda by supporting black businesses and creating jobs.

The commercial portfolio saw significant improvement during the reporting period, with revenue increasing by 57% to R2.1 billion (2021: R1.3 billion). This was due to the increase inpassenger numbers and the lifting of certain trade restrictions as lockdown levels were eased. The improvement takes into consideration rental revenue reprieves of R591 million 2021: R1.4 billion) granted to tenants to offset the negative impact of the pandemic.

While our commercial operations are on the road to recovery, we anticipate that it will take some time for revenue to return to pre-COVID levels, especially as the pandemic has resulted in a realignment of the air travel market and changes in consumer behaviour.

Advertising

Revenue from the advertising business decreased to R29 million in the reporting period compared to R41 million in FY2021.

The upswing in passenger volumes and improving economic conditions resulted in an incremental increase in demand for airport advertising. However, growth remained constrained due to businesses reducing their advertising spend throughout the pandemic. The unprecedentedly high vacancy levels experienced in the previous reporting period were maintained for FY2022.

Rental relief in the form of reprieves granted to concessionaires during the reporting period further reduced revenues for the 2022 financial year.

Retail

As with advertising revenue, retail turnover slumped dramatically in the previous period and only started to regain ground during the reporting period. The slump in the 2021 financial year was due to the disruption of retail sales related to international travel, the restrictions on the sale of tobacco and liquor, and restricted operations due to the various levels of lockdown in place throughout the year. Across the network, many retail outlets were forced to close down permanently as they had become unsustainable, resulting in a significant loss of rental income.

Retail revenue nevertheless increases by 95.8% to R607 million (2021: R310 million) during the reporting period due to the increase in passenger traffic volumes. Retail revenue per passenger did, however, decrease by 15.8% to R57.08(2021: R67.77).

Prior to the pandemic, international departures contributed 82% towards total retail sales. As the market has since shifted and as travel patterns have changes, our retail businesses have come to rely more heavily on domestic and regional travellers.

Car parking

Car parking has experienced a robust recovery trajectory that is directly corelated to the improvement in passenger numbers across the network. Parking remains the selection of choice when compared with alternative modes of transport. The recorded parking usage indicates that most of the airports have moved from an optimum supply state pre-COVID, to an oversupply state in terms of capacity management and utilisation.

Car parking revenue increased by 117% to R353 millioncompared to the previous year’s performance of R163 million.

This segment has recovered well, exceeding budgeted values and, with a 61% recovery compared to pre-COVID performance, it remained resilient throughout the financial year. The repurposing of underutilised parking infrastructure remains a high priority, with various initiatives rolled out during the reporting period contributing material gains in revenue performance.

The recovery trajectory seen in the past 12 months looks set to continue into the current year (FY2023).

Car rental

Car rental saw an improvement of R153 million to R225 million (2021: R72 million) in revenue. This performance was aligned to the increase in passenger volumes. Growth was further driven by the reversion to pre-pandemic minimum guaranteed rentals over the reporting period.

Property

During the 2022 financial year, there was a recovery of 12.3% in property revenue to R729 million (2021: R656 million).

The property portfolio, by and large, secured rental increases for the year, with the industrial portfolio (warehouses,workshops and hangars) accounting for 32% of the business. It therefore seems to be on par for a full recovery. The diverse portfolio (hotels, fuel farms and filling stations) accounts for 3% of revenue and showed positive recovery in the latter part of the year. The terminal office portfolio, which accounts for 35% of revenue, nevertheless continues to be under pressure due to the continued oversupply of office space and the adoption of hybrid working arrangements.

REVENUE FROM NON-CORE ACTIVITIES

The non-core commercial portfolio generated R36 million in revenue and accounted for 1.7% of non-aeronautical revenue.

OUTLOOK

With COVID-19 restrictions having been lifted post year-end on 22 June 2022, we are able to begin the long journey towards recovery and development in earnest.

During the current period and going forward, we will remain focused on our core business of running airports and will continue to strive for continuous improvement in the passenger experience. Simultaneously, we will focus on extending and developing our cargo handling capabilities and the services we offer to our customers in the cargo and logistics businesses.

More ambitiously, we are aiming to redefine the place of the airport in city life and to make airport hubs more attractive leisure destinations for both passengers and the public in general. We intend to do this by diversifying our range of services and by working towards creating an integrated and interconnected aerotropolis at each of our airports. We will continue to do so in cooperation with our shareholder, our business partners and all of our stakeholders.