Although recovery has been slow with sporadic reversion, the ACSA network had recovered to 49% of its pre-COVID passenger throughput by 31 March 2022, with 20.9 million passengers having passed through our airports during the course of the reporting period.

MESSAGE FROM THE CEO

Mpumi Z Mpofu

CEO

NAVIGATING FY2022 AND BEYOND

The Covid-19 pandemic continued to be the most significant challenge we had to face throughout the reporting period, with various levels of lockdowns and travel restrictions at home and abroad severely constraining air travel and transportation. The strategic, financial and operational responses we put into place enabled us to sustain the business through this protracted period of uncertainty and begin charting a viable way forward, as restrictions began to ease prior to the 2021 year-end holidays.

Our primary consideration was and remains the safety of our staff, passengers and other stakeholders, and we continued to adhere to all mandated risk management measures to minimise the spread of the virus.

Adjustments to local and international lockdown levels and travel restrictions required exceptional flexibility at operational level, with infrastructure and services having to be brought into service and curtailed again at extremely short notice. At times, this compromised our ability to deliver the quality and efficiency of services that we pride ourselves in, however, whenever these interruptions occurred, our staff worked swiftly to rectify the situation and minimise the impact on our passengers.

A further challenge to the business was the loss of skills, capacity and institutional knowledge resulting from the need to reduce operational costs and therefore staff numbers.

In consultation with our staff and their respective unions, we undertook a programme for early retirement and voluntary separation packages (VSPs) in 2020 and this was extended through to 31 January 2022. We also re-aligned the payment for overtime work required on Sundays, all of which realised the savings needed to keep the business sustainable. I would like to take this opportunity to thank our staff for their input, engagement and cooperation during this process, which was difficult for all involved.

Throughout the business, we continued to implement the Recover and Sustain Strategy and financial plan which were approved by the Board in the previous period and to adjust it as necessary in order to adapt to changing circumstances. The Corporate Plan, which is based on this strategy and financial plan, provide a comprehensive operational framework to guide the business through the uncertainties we anticipate will continue until at least FY2024 and provides for growth to FY2030 and beyond.

SIGNS OF RECOVERY

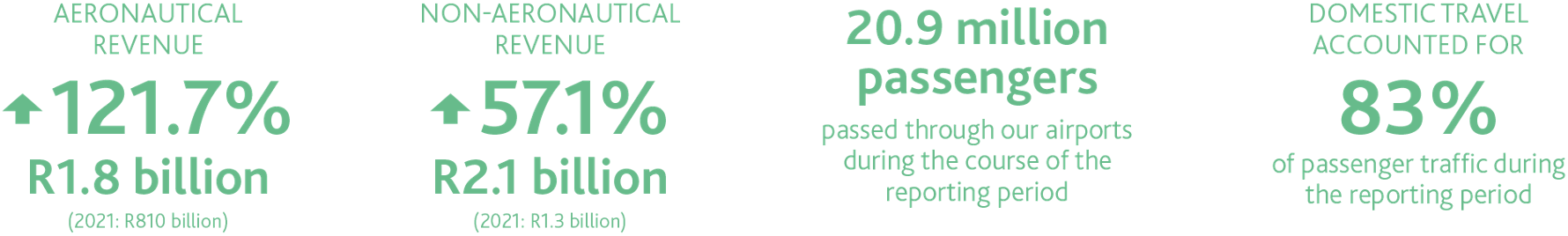

Although recovery has been slow with sporadic reversion, the ACSA network had recovered to 49% of its pre-COVID passenger throughput by 31 March 2022, with 20.9 million passengers having passed through our airports during the course of the reporting period. Domestic travel accounted for the majority of these passengers, with this segment having recovered to 56% of its pre-COVID throughput by year-end.

Domestic travel accounted for 83% of passenger traffic during the reporting period, with regional passenger numbers also improving due to leisure and VFR (Visiting Friends and Relatives) traffic. Pre-COVID, the domestic segment accounted for 70% of total passenger traffic.

Reduced travel budgets and the move to remote and hybrid working arrangements have, however, impacted on travel in the business, government and MICE (meetings, incentives, conferences and exhibitions) segments and we foresee this trend continuing in the current period (FY2023).

According to currently published schedules, we anticipate that by October 2022 the ACSA network will operate at 84% of its pre-COVID seat capacity. We expect the domestic segment to recover to 91% of its pre-COVID seat capacity and the international segment to 70% of its pre-COVID capacity.

THREATS TO RECOVERY

Uncertainty relating to the war in Ukraine and the impact it is having on both the global and local economies is, however, a notable threat to recovery.

Prior to Russia’s invasion of Ukraine in February 2022, recovery from the pandemic was expected to continue slowly but progressively throughout 2022 and 2023, supported by vaccination programmes, the easing of travel restrictions and the macroeconomic recovery policies in place in all the major economies. Since then, however, disruptions to food production in Ukraine and in global food and energy supply chains have had an immediate effect of the availability of key commodities and, in turn, on inflation. Global growth projections for 2022 have therefore been adjusted down from 6.1% to 3.6%. Decreased business and investor confidence is also leading to a tightening of financial conditions and may lead to capital outflows from emerging markets.

In addition, the war has rendered trade with Ukraine and Russia all but impossible and given that South Africa is Russia’s fourth largest trading partner in Africa, this will undoubtedly affect export volumes.

In the aviation sector, higher jet fuel costs are having a direct impact on operating costs, resulting in increases in ticket prices and a softening of demand for air travel – especially international air travel – at a time when the industry can least afford another serious dip in demand. In addition, Russian air space remains closed to 36 countries, including the US, Canada and the EU, with the result that 20% of global air cargo traffic has been affected.

OUR RESPONSE

With these issues in mind, we need to focus on our core capabilities in the short term and on diversification of our revenue streams in the medium and long term. Running airports is our core business and operational efficiency will be our primary focus over the next four years as we regain lost ground. We will simultaneously focus on diversifying our revenue streams to maximise commercial and cargo-related opportunities.

In line with our second strategic pillar, namely developing airports, we will focus on the planning necessary to make the airport environment more attractive and engaging for both passengers and the communities living around our airports. Our Aerotropolis Strategy (covered in detail later in this report) aims to develop aerotropoli at our three largest airports, and is the underlying concept that will vastly improve both passenger and cargo handling capabilities. In addition, we intend to create six smaller smart airport cities that will redefine the role and function of airports located in smaller cities and towns.

To ensure that we are able to deliver on our objectives over all timeframes, we have implemented the new Revised Governance Framework and Operating Model, Capability Model and Organisational Structure that were developed in the previous period. These allow for the regional integration of our airports at operational level, embedding airports in their local economies in order to rationalise costs, maximisation of opportunities for revenue generation, and sustainability.

GROWTH STRATEGY

While large, uncontracted infrastructure development projects remain on hold for the foreseeable future, planning for growth is a priority. This is necessary in order to secure the long-term sustainability of our business and to fulfil our broader objective of facilitating economic prosperity, social equity and environmental integrity, an objective which is aligned to the United Nations Sustainable Development Goals. The Growth Strategy was developed and finalised during this reporting period with a focus on Passenger Mobilisation, Aerotropolis, Cargo, Global, Ground Handling and Fuel Strategies to grow the business and diversify revenues in the short to medium term.

As we respond to the uncertainties in our operating environment, we continue to manage costs within the framework of our revised Financial Plan. As part of this effort, we extended the early retirement and voluntary separation programme introduced in the previous period to January 2022. The moratorium on recruitment also remained in place during the reporting period, no salary increases were granted and no incentives were paid. Further details on management of costs are provided in the CFO’s Message.

FINANCIAL PERFORMANCE

As our results show, revenue improved by 81.1% to R3.9 billion (2021: R2.2 billion), largely as a result of the partial recovery in passenger air travel during the period. This, however, remains well below the revenue of R7 billion reported in FY2019, prior to the onset of the pandemic. Earnings did, however, move into positive territory and we have reported an EBITDA of R366 million (2021: -R1.8 billion).

Aeronautical revenue, which is derived from regulated charges or tariffs related to aircraft landing and passenger service charges, improved by 121.7% to R1.8 billion (2021: R810 million), while non-aeronautical revenue, which is derived from commercial activities at our airports, increased by 57.1% to R2.1 billion (2021: R1.3 billion)

As in the previous period, there were some operational cost savings due to curtailed operations, but employee severance costs were significant.

ECONOMIC REGULATION

Engagement with the Regulating Committee is an ongoing priority. In the run-up to the 2022 to 2026 permission application, we shared our revised strategy and financial plan with the Regulating Committee and demonstrated the importance of tariff assistance to the Company’s long-term sustainability. Significant uncertainty persists regarding South Africa’s regulatory framework and this impacts on our decision-making.

ACSA has during this period engaged within the ACI World with respect to changes necessary in the global policy environment through ICAO for Air Transport Economic Regulation which requires extensive review give the adverse impact of Covid-19 and the dire need to diversify our revenue stream and improve our financial sustainability. The result has been that ACI-World will present a Paper on Revision of the ICAO policy on Airport Charges at the ICAO General Assembly.

RUN AIRPORTS

As already mentioned, annual passenger traffic volumes remained significantly below pre-COVID levels throughout the financial year, although the number of passengers passing through our airports increased by 49% compared to the previous financial year. Regional airports contributed significantly to this recovery, with George Airport and Bram Fischer Airport experiencing passenger throughput of over 96% and 84% respectively in March 2022. The domestic and regional markets are largely driven by leisure and VFR traffic, which continues lead the recovery in air travel.

In addition, many domestic and regional airlines restored the majority of their route networks during the period, although they continue to operate at a reduced scale. New domestic airlines have, however, provided additional capacity, which is supporting air traffic recovery. Predictably, international passenger traffic volumes lag significantly behind domestic and regional volumes, with O.R. Tambo International having been most affected by this during the course of the year. Amendments to travel restrictions in the third quarter of the year nevertheless saw the airport recovering to 64% of its pre-COVID throughput in March 2022.

OUTLOOK

The easing of global travel restrictions since late December 2022 is supporting a recovery in air traffic worldwide, although markets and travel patterns have changed over the past two years, and this will have a lasting effect on passenger travel in particular. We foresee that both traditional and COVID-related factors will continue to influence the recovery of passenger travel during the

current period and beyond.

Traditional factors include economic conditions, levels of disposal income, ticket prices, geopolitics, the effects of globalisation and environmental concerns. Additional COVID-related factors include travel restrictions, vaccination and testing requirements, consumer concerns about the risks of exposure to the virus when travelling by air, the move to remote and hybrid working, the drop-off in travel in the business and MICE segments, and airline and airport operations experiences.

Within this context, we will continue to provide a safe and secure environment for our passengers and stakeholders and to engage with businesses and government departments in the aviation and related sectors to support recovery.

Going forward, we have identified the need to diversify our revenue streams and to focus our activities through the Growth Strategy in the commercial and cargo segments. This process is already underway within the confines of the existing infrastructure and budgets. In the medium and long term, we will focus on expanding our infrastructure and capacity in order to support our revenue diversification objectives.

APPRECIATION

In concluding, I would like to extend my sincere thanks to our staff for their hard work and the commitment they have shown to meeting the ongoing challenges posed by the pandemic. Not least, special thanks are due to the staff members who were willing to take early retirement or enter into voluntary separation agreements, which enabled us to secure the Company’s long-term sustainability. I further commend the Executive and management teams for their flexibility and innovative approach to steering the Company through such an unprecedented period in our history. To all our airport stakeholders, thank you for your contribution to keeping our airports safe and running efficiently under exceptional circumstances. I would also like to extend my appreciation to our Board for its unwavering dedication and guidance during yet another challenging year. Finally, to our shareholders, investors and lenders, thank you for your ongoing support and confidence in our business. We remain committed to being one of the world’s leading airport operators.