GROW FOOTPRINT

OVERVIEW

Our strategic focus on growing our footprint is a response to changing opportunities in the domestic, regional and international air transport markets. While growth is currently not a primary focus for the business, it remains a medium- to long-term focus as it is vital for sustainable value creation.

Within the context of our Recover and Sustain Strategy, we are therefore continuing to consider opportunities for growth by re-evaluating our investments and nurturing identified growth areas. Strengthening and expanding our presence in segments such as cargo handling will, for instance, allow us to expand on our core business activities and support our objective of diversifying our revenue streams.

During the past two periods, our focus has been on sustaining liquidity in response to the challenges presented by the pandemic, while nevertheless ensuring that we do not lose focus on the need to plan for future growth. Our primary concern has therefore been to realise the equity held in under-performing investments in order to support liquidity, to secure our most viable routes and to restore passenger traffic as best possible given the constraints under which we have been operating.

The various levels of lockdown during the 2021 and 2022 financial years not only impacted heavily on airport operations, but also resulted in subdued demand for airport services, concessions and training. In this respect, we were nevertheless able to rely on existing contracts, such as our management contracts with Mumbai International Airport in India and Kenneth Kaunda International Airport in Kenya to generate non-core revenue.

Further, despite unfavourable conditions for airports around the world, we were still able to secure new advisory and consultancy work during both periods.

REALISING EQUITY INVESTMENTS

During the 2022 financial year, we were also able to finalise the sale and purchase agreement (SPA) for the sale of our equity stake in Guarulhos International Airport in São Paulo, Brazil. The SPA was, however, eventually terminated due to failure by the buyer to meet the applicable conditions precedent, specifically the lender’s approval.

The decision to sell this investment is nevertheless still in place, not only for the purpose of improving our liquidity

position, but also to eliminate our exposure to contingent liabilities and the potential equity injection obligations embedded in the concession. Further investment in airport concessions has been put on hold for the foreseeable future and this decision will be reviewed in the future based on our liquidity position.

PASSENGER TRAFFIC

Various levels of lockdown throughout the year continued to place severe constraints on passenger travel, especially to and from international destinations. The easing of restrictions from time to time was not always met with demand or, in contrast, demand exceeded our ability to upscale operations at short notice. This led to difficulties in maintaining service levels in some areas of the business, although the implementation of COVID-19 protocols was consistent and did not impact significantly on service quality.

Despite the challenges of the reporting period, passenger throughput improved by 48% compared to the previous period, with 20.9 million passengers passing through our airports.

Higher input costs, largely due to the increase in the price of jet fuel due to the war in Ukraine, will continue to impact on ticket prices and therefore on the affordability of air travel. This will be exacerbated by the high inflation rate in South Africa, which will have a direct impact on disposable income. Both of these factors are likely to result in a more prolonged period of recovery than we had anticipated.

BUSINESS DEVELOPMENT

Our Business Development team has extensive experience, spanning multiple industries within the aviation sector. We work closely with our partners to analyse and validate route performance in order to identify opportunities for retention and expansion. We also collaborate with key stakeholders – from tourism authorities to local government and provincial structures – in order to ensure alignment with the national trade and tourism agendas.

Prior to the pandemic, several airlines in North America, Europe and sub-Saharan Africa had announced their intention to commence direct services to and from South Africa, reflecting the importance they placed on growth opportunities inherent in the South African market. These plans were, however, disrupted by the pandemic and the resulting restrictions on international travel.

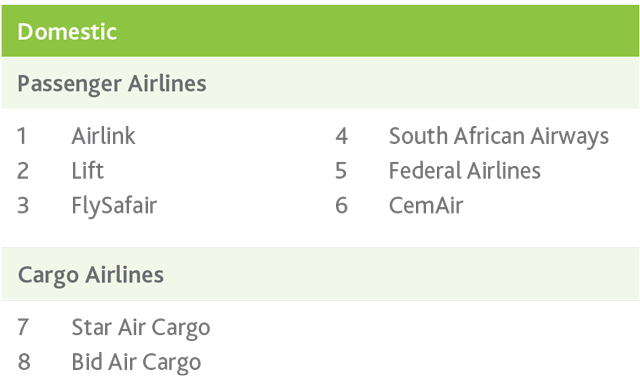

The following airlines are operating scheduled flights to and from our airports:

A number of developments are expected in the international markets during the current period. Firstly, Condor, a German-based leisure airline, will launch two weekly flights between Frankfurt International Airport in Hessen, Germany and O.R. Tambo International Airport in Johannesburg from November 2022. Condor’s flights to Johannesburg will be in addition to the three weekly flights planned for Cape Town International, which are also scheduled to begin in November. Condor will effectively operate five direct weekly flights into South Africa, linking Johannesburg and Cape Town to Frankfurt. The airline will operate both the Johannesburg and Cape Town flights on a seasonal basis.

Royal Eswatini National Airways Corporation (RENAC), the national carrier of Eswatini, will operate three daily flights to O.R. Tambo International, two daily flights to King Shaka International and one daily flight to Cape Town International from King Mswati III International Airport in Mbabane.

Air Belgium will operate three weekly flights to South Africa, with one weekly frequency linking Brussels to Cape Town via Johannesburg. These flights will also be operated on a seasonal basis.

Domestically, several airlines have restored most of their pre-COVID route networks, although they are operating at reduced frequency. Some domestic airlines that were operational prior to the pandemic are, however, no longer operational, including SAExpress, Mango and the Comair Group, which operated Kulula and British Airways. The grounding of Comair and the airline’s subsequent liquidation will have a significant impact on our network’s recovery.

ROUTE DEVELOPMENT

Airports Company South Africa is a founding member of several route development structures that, in collaboration local government, facilitate wider access to air travel and transportation. Despite restrictions, most of these structures remained active throughout the pandemic.

While activity has been concentrated around the country’s three largest airports during the past two periods, enabling connectivity between smaller communities and large cities remains a top priority for us. We have therefore continued to work closely with local government to explore various mechanisms that will enable smaller communities to plug into the national air transport network.

During the reporting period, the following structures were active:

- Gauteng Air Access. The Department of Tourism actively drives route development for O.R. Tambo International in partnership with the City of Ekurhuleni, the Gauteng Tourism Agency, the Gauteng Growth and Development Agency and South African Tourism.

- Durban Direct, which operates in partnership with Dube Tradeport and the Department of Economic Development and Environmental Affairs.

- Cape Town Air Access, which operates in partnership with Wesgro (a trade and investment agency), Cape Town Tourism, the Department of Economic Development and Environmental Affairs, South African Tourism and private sector partners.

- Garden Route Airlift, which operates in partnership with George Municipality and the Garden Route District Municipality.

- Nelson Mandela Bay Airlift, which operates in partnership with Nelson Mandela Bay Metropolitan Municipality, the Eastern Cape Development Corporation, the Eastern Cape Parks and Tourism Agency and the Nelson Mandela Chamber of Commerce.

- Upington Airlift, which operates in partnership: in partnership with the Dawid Kruiper Local Municipality, the Department of Trade and Industry, the Department of Economic Development and Tourism and the local Chamber of Commerce

NON-CORE REVENUE

Non-core revenue generated from business development advisory services and consultancy amounted to R9.7 million for the reporting period. Among other projects, we delivered operational readiness and airport transfer projects for the new passenger terminals and associated infrastructure at Kenneth Kaunda International Airport in Lusaka and at Simon Mwansa Kapwepwe International Airport in Ndola for Zambia’s National Airports Corporation Limited (ZACL).

Advisory and consulting services

Our business model is based on leveraging our expertise in airport management, technical advisory services, business services and the training academy. However, with little demand for technical advisory services since the advent of the pandemic, our approach has been to keep our staffing levels in this area of the business low and rather to partner with external advisors and/or consultants to address any

expertise gaps in the provisionof advisory services. In the long term, any material gap in skills will be addressed in line with sustained demand from the market.

Commercialising our training academy

In order to capitalise on the opportunities available to diversify our revenue streams, we are in the process of transforming our training academy into an industry-wide African regional aviation training centre of excellence. The centre will be a stand-alone entity that will leverage our human capital, institutional knowledge and experience to offer tailored programmes for both internal and external clients.

OUTLOOK

As mentioned, we expect passenger traffic to continue to recover steadily throughout the 2023 financial year, although the rate of recovery is unpredictable. The evolution of the COVID-19 pandemic remains uncertain and it still poses a downside risk for air traffic recovery. Uncertainty relating to South African Aviation policy also continues to erode confidence amongst airlines and constraint bilateral air-service agreements will continue to limit air traffic recovery and growth potential.

Within this context, we will nevertheless continue to implement capacity expansion projects that were already in progress at the start of the pandemic, but will keep further expansion projects on hold. We will, instead, be refocusing our "Grow Footprint" objective on leveraging capacity that will support the diversification of revenue streams, while simultaneously continuing to plan for the implementation of our Aerotropolis Strategy and for expansion into potentially high-growth markets in Africa.

We will also continue to focus on strengthening our route pipeline within the constraints of demand. We have identified 55 destinations in 39 countries as underserved and have earmarked these for development in the medium term. Of these, 21 destinations are located in 17 countries in Africa, the region which offers the most opportunities for us to grow our footprint within the next decade.

Our ultimate goal is to establish connections to every major city in Africa, thereby diversifying our international source market portfolio and supporting Africa’s broader regional integration objectives in line with the Abuja Treaty of 1991.