DEVELOP AIRPORTS

OVERVIEW

Developing world-class airport infrastructure that is designed to meet the needs of our customers and aligned with industry requirements supports our vision of being a world-leading airport business. The severe financial impact of the pandemic has, however, meant that we have had to re-look some of our development timelines.

Prior to the advent of COVID-19, with many of our airports operating at or near design capacity during peak hours, we were planning large capital investment programmes to expand and/or eliminate bottlenecks at some airports in the network. The feasibility for many of these projects had been completed and we were in the process of making awards for detailed design and development.

With the onset of the pandemic, we reassessed our capital programme in response to revised traffic forecasts and financial affordability. Now that the aviation business in recovery mode, we will perform independent traffic forecasts to determine the sequence and pace of our planned expansion projects.

The projects that are currently in implementation align to our Recover and Sustain Strategy and our revised Financial Plan. Priority has been given to projects that:- protect the airport’s license to operate;

- provide a safe travel environment for passengers;

- mitigate risk;

- ensure that facilities remain compliant with regulations;

- allow for equipment to be replaced when we have been unable to secure the operating baseline through overhauls and/or intensified maintenance; and

- were in implementation prior to COVID-19 and where the value of the infrastructure on completion will far exceed the cancellation costs.

We remain committed to improving and expanding the infrastructure in our network in order to unlock both the commercial and development potential inherent in our airports and to grow our footprint, especially in Africa. We anticipate that this will deliver significant socio-economic benefits at both national and regional level.

ENTERPRISE PROJECT MANAGEMENT

Our capital investment programme is managed through our Enterprise Project Management Office (EPMO), which enables us to evaluate and respond to business and financial challenges in a structured and centralised way.

Over the past two years, the EPMO has reprioritised our capital expenditure plan to take into account the changes that have taken place in the operating environment.

As a first response to the impact of COVID-19, our five-year capital development budget was reduced from R30 billion to under R5 billion. This was done by prioritising replacement, refurbishment and safety-critical projects over capacity creation, with capital allocation targets being set at enterprise level.

The EPMO developed and implemented a standardised EPM environment and a set of 32 project management frameworks, which include roles and functions that support the new lifecycle management methodology adopted in 2020. These align all project management office functions and gate controls across IT, maintenance and engineering, security, major infrastructure and fleet. As a result, our project management maturity is expected to improve significantly, resulting in greater efficiency and better cost containment. An online EPM training solution is being developed, which will provide for the continuous maintenance and improvement of project management skills and capacity.

INFRASTRUCTURE PLANNING

Master plans that are closely aligned to our overall business strategy and development plans are crafted for each airport and duly aligned to municipal development plans. They address the integration of airport development into the local authority’s broader spatial development plans and more needs-specific plans such as integrated transport plans. An airport master plan is an expression of a vision for the ultimate development of the airport and a road map for efficiently meeting aviation demand in the foreseeable future, while still preserving the flexibility necessary to respond to changing industry conditions. Airport master plans also consider infrastructure enablement such as bulk services, access routes and environmental conditions.

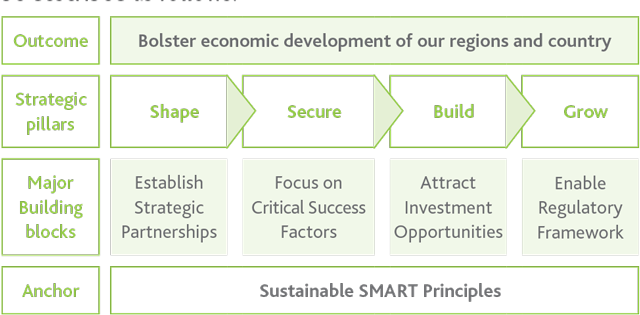

At ACSA, we have adopted an integrated approach to airport planning and development, which is expressed in our Aerotropolis Strategy. An aerotropolis is defined as a city or urban area centred around an airport, with the airport fulfilling multiple functions.

In terms of this strategy, our aim is to define specific critical success factors for each airport, to support these by creating enabling conditions, and to identify appropriate developments, projects, and initiatives for that airport.

The master plan for each airport identifies the kind of infrastructure needed at that location, defines the precincts within the airport in which that infrastructure is needed, allows for the development of detailed development plans for areas such as the terminal precinct and the cargo precinct, and provides for the development and implementation of individual projects, such as terminal buildings, parkades or aircraft stands.

The aim of the Aerotropolis Strategy is to promote economic growth and development for the benefit of the Company, the regions in which the airports operate and the country as a whole. On a macroeconomic level, it is aligned to the goals of the National Development Plan and, from a business perspective, it is intended to improve our competitiveness, maximise revenues, improve the accessibility of our airports and promote connectivity between airports and regional hubs.

Based on extensive research of the aerotropolis concept and its application around the world, as well as a review of South African policies and development frameworks, our strategy can be described as follows:

The vision for ACSA’s aerotropolises and airport cities is to attract smart, relevant aviation and non-aviation development to our airports in order to diversify our income streams and, ultimately, to secure our long-term sustainability.

The execution of this strategy depends on several critical success factors, namely strategic partnerships in both the public and private sectors, suitable investment opportunities, the availability of adequate capital budget, an integrated approach to project planning and implementation, and a responsive regulatory framework.

To date, aerotropolis master plans have been concluded for the City of Ekurhuleni, where O.R. Tambo International is located, and the City of Durban, where King Shaka International is located. In addition, an aerotropolis feasibility study has been conducted for the City of Cape Town and the outcomes of this are being used to inform our strategy for that airport and the Western Cape regional hub.

INNOVATION

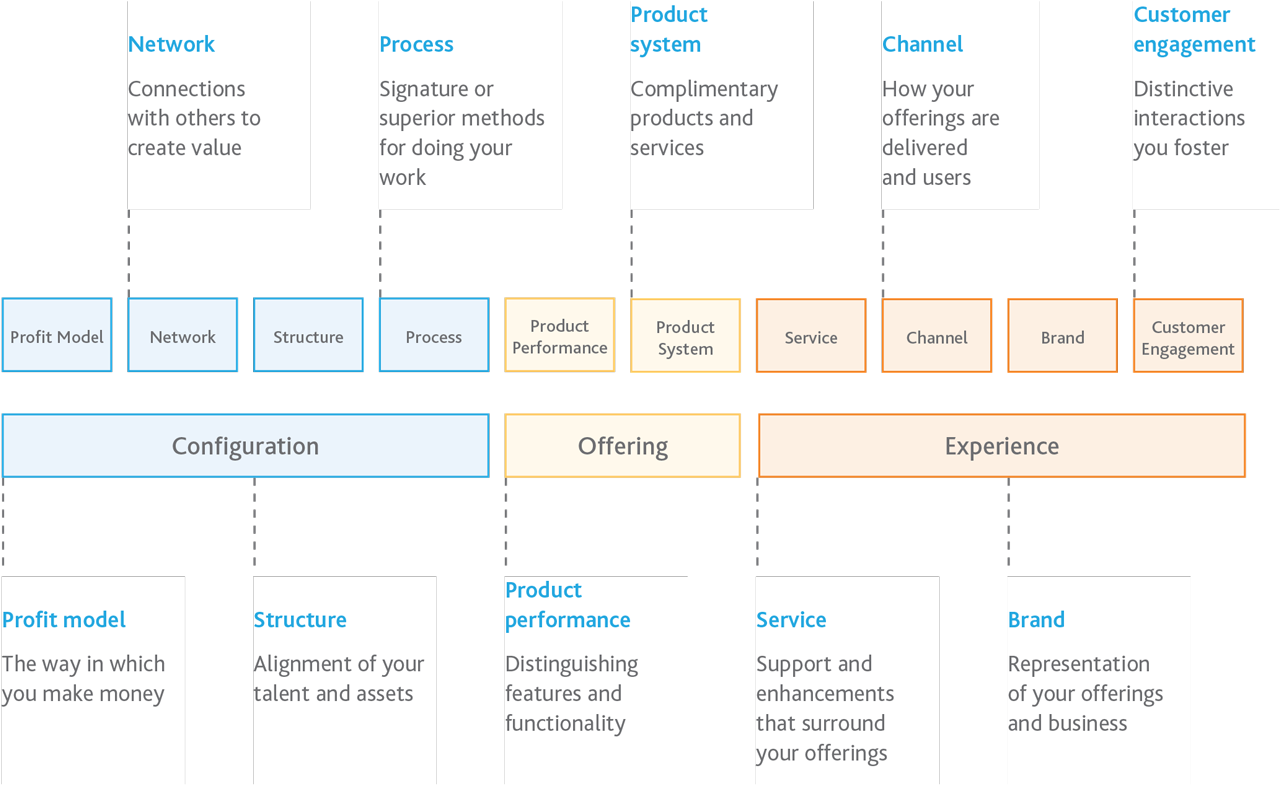

Innovation at all levels is essential to the implementation and success of our Aerotropolis Strategy as well as our regional integration efforts. We have therefore put a revised Innovation Strategy into place that intends to harness the power of evolutionary innovation, breakthrough innovation and revolutionary innovation, and which takes into account the need for different types of innovation throughout the business.

Our value proposition for innovation initiatives is based on leveraging our existing knowledge base by implementing best-practice knowledge management systems and finding strategic ways to incorporate new technologies to align with leading digital airport business trends. We evaluate and prioritise innovation initiatives in line with core business objectives such as reducing costs, improving productivity and providing better customer satisfaction.

We have therefore undertaken a number of initiatives with these objectives in mind. They include a self-service programme that complements the IATA Fast Travel programme and which is designed to provide passengers with more extensive automated and touchless services. These are delivered online, via our app or on-site at our airports. New integrated technologies, including biometric identification technologies, are also being used to improve airport security and to provide passengers with robust, swift and smooth processes. All of these innovations are intended to improve the overall user experience and to promote our post-COVID recovery.

In addition, multiple energy-efficiency initiatives are either in place or are being implemented throughout our network. These include active solar farms at four of our airports as well as geothermal, gas-generated, solar, wind and waste-to-power initiatives. A fifth solar farm is currently in development and all of these initiatives not only help to reduce our carbon footprint, but also our dependence on the national grid. In the long term, we aim to move all of our operations off-grid. We are also aiming to be carbon neutral by 2030 and continue to hold ISO 4001 carbon accreditation from ACI (Airports Council International).

Internally, an innovation idea-generation portal has been developed and is being implemented. This allows employees to submit innovative ideas and potential solutions aimed at resolving current problems and inefficiencies. The portal is intended to further enhance our approach to innovation for both internal and external stakeholders and, consequently, to improve our levels of service for all airport users.

PROPERTY DEVELOPMENT AND ASSET MANAGEMENT

Property development

The property development portfolio aims to monetise land in and around our airports through the development of infrastructure and opportunities that are adjacent and complementary to our core business of running airports. Typical investments include conference facilities, transportation nodes, cargo facilities, office parks and logistics platforms. The portfolio is vitally important to minimising air travel costs as the revenue generated from these developments reduces or, in some cases, even offsets the cost of operating the airport.

Due to the impact of COVID-19, all development opportunities dependent on the increase in passenger traffic have been deferred. During the 2021 financial year, we nevertheless completed projects to expand facilities at certain cargo operators and refurbished certain hangars. ACSA’s new office park at O.R. Tambo International was also completed.

New corporate offices

The construction of our new corporate offices on a site adjacent to O.R. Tambo International Airport was completed during the reporting period and we have taken occupation of the building. The 33 000m2 Aviation Park campus comprises three buildings. Building A houses ACSA, while Building B and Building C are in the process of being let.

The development is a world-class facility that has been granted a four-star rating for sustainable building design by the Green Building Council of South Africa. This relates in large part to the use of energy-efficient infrastructure, which features primary lighting by natural light, occupancy sensors to minimise electricity usage, the use of rain water harvesting and vegetated areas that promote natural thermal inertia.There is also a sophisticated building management system (BMS) in place, which ensures all the sub-systems of the building are working in harmony to achieve the most efficient and sustainable outcomes.

Aviation Park is the first major infrastructure development project we have undertaken in the past ten years and is testimony to our ability to manage large infrastructure projects.

More specific infrastructure development projects , including the recently completed extension of the FedEx cargo facility at Cape Town International Airport, have also continued. All of these projects are backed by sound business cases for the developments.

Enterprise asset management

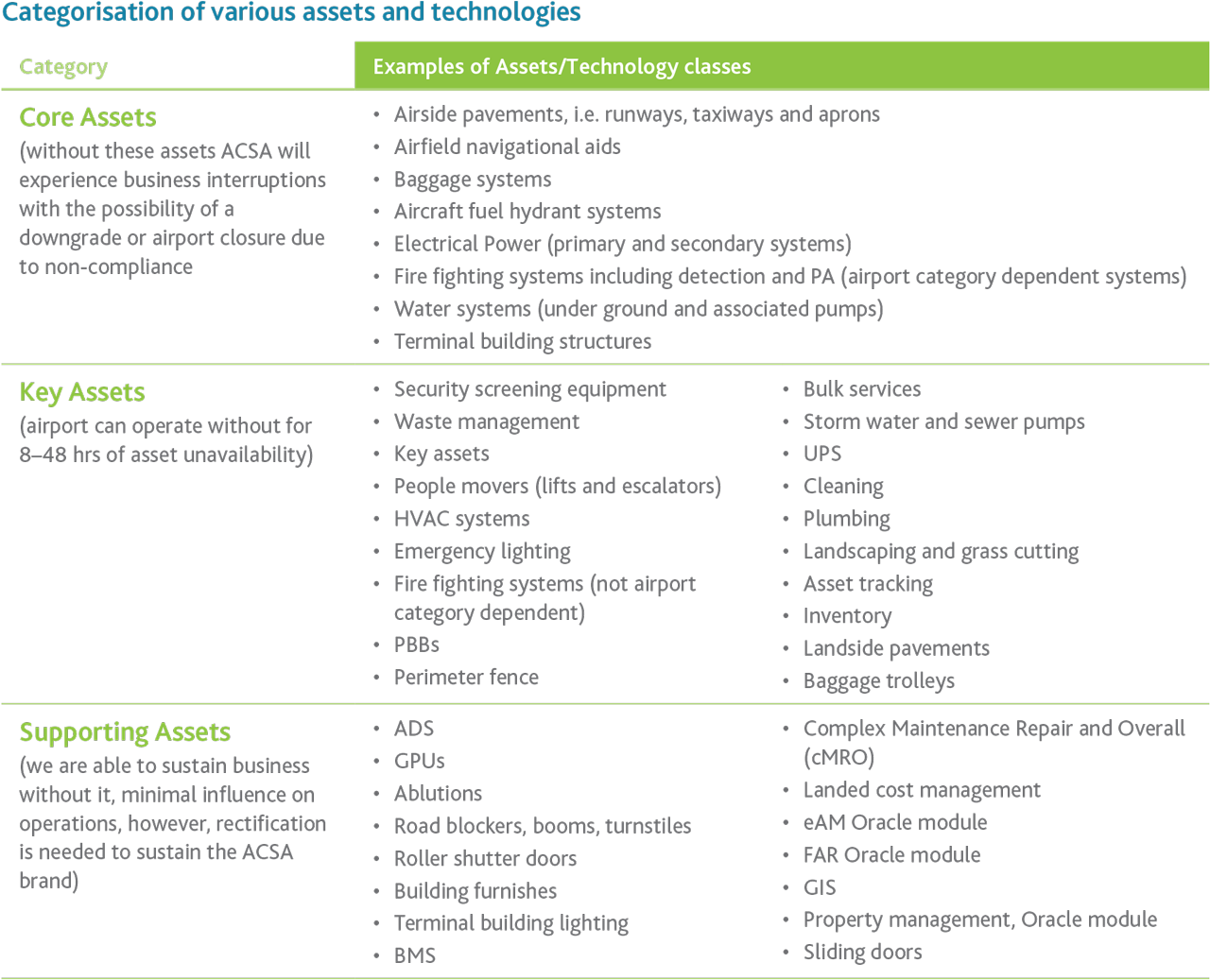

Enterprise Asset Management is charged with managing ACSA’s infrastructure and assets throughout their lifecycle. This includes responsibility for optimising the return on asset levels through safe and relevant engineering practises and technology selection that is suitable for an airport environment. As we emerged from the pandemic and a period of more than two years during which there was a significant reduction in capital and operational expenditure, the focus for Enterprise Asset Management was to ensure that infrastructure and operations were scaled to passenger traffic at an acceptable cost. Repair and maintenance costs were therefore reduced by 30%, while the cost of cleaning was reduced by 40%.

This was achieved through the implementation of a mothballing and asset recertification programme. Mothballing refers to the safe shutdown and continuous monitoring of dormant equipment, while asset recertification refers to the process followed before an asset can be put back into service.

During the cost reduction programme, we were guided by our maintenance regime standards for core, key and supporting assets. This ensures the safety of airport operations and compliance with regulatory standards.

The ability to achieve and sustain the reduced cost baselines is also attributable to:

- Implementing a revised service catalogue for maintenance services. This catalogue bundles like services so that full-time equivalents needed to service a contract are reduced and the contract specifications are informed by the maintenance regimes to be implemented; in other words we have adopted an output-based service contracting approach.

- Critical review. This is a process of deciding which maintenance activities can be performed by in-house artisans and technical staff (e.g. weekly generator on-load testing and asset inspections). The tooling, training and development of staff necessary for this has been completed and the programme implemented. An added benefit is that first-line maintenance department staff now have enhanced technical skills and equipment know-how.

Moving forward, we will implement an in-house asset assurance programme to ensure the timely completion of maintenance regimes at quality and regulatory standards. In cases in which quality assurance is performed by a certified inspector (e.g. a lift inspector or a refrigeration technician), these will continue as well. In the current period (FY2023), we expect to see an increase in cleaning and maintenance costs as passenger traffic recovers, resulting in longer operating hours at all of our airports. Airport infrastructure and equipment redundancy reduce sharply with recovery.

The reduction in capital expenditure has also impacted the asset management function. Projects have been prioritised according to safety and risk; recurring and/or single points of failure; end of life; technology obsolescence and modernisation. This approach is likely continue over the next two to three years until the business has fully recovered from the effects of COVID-19.

In order to catch up on capital backlog, we will revisit our plans to implement a rolling capital programme, which was discussed with the aviation industry in January 2020. This will entail a cyclical renewal of infrastructure and assets using replicable implementation standards and processes. This will eliminate duplication in engineering design and accelerate execution as a result of lessons learned from prior projects. There are firm plans to present this at the permission consultation and regulatory meeting for approval.

OUTLOOK

While we saw a promising recovery in our business during the reporting period, we expect financing constraints and the changing operating environment to continue to have an impact on our capital expenditure programme. Within this context, we will continue to prioritise projects that minimise business risk, support sustainability and enable us to be responsive to changing market needs. The limited funding available for capital development will be allocated to business-critical projects.